Karma Tsultrim Wangchuk highlighted in his/her letter to ST Forum today that we are being charged GST on Water Conservation Tax. Are we being tax on a tax? If it is, when? When have we been paying the Water Conservation Tax (WCT)?

Karma Tsultrim Wangchuk highlighted in his/her letter to ST Forum today that we are being charged GST on Water Conservation Tax. Are we being tax on a tax? If it is, when? When have we been paying the Water Conservation Tax (WCT)?

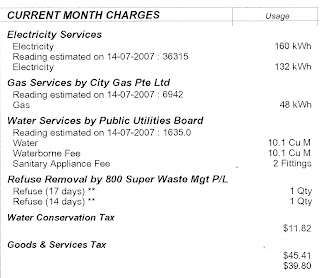

I checked my latest PUB bill. There is an item called WCT valued at $3.54 ie. 30% of $11.82 worth of water I have used in the past month. GST of 7% is then applied on the total utilities costs and WCT. Wangchuk asked Ministry of Finance (MOF) to explain.

Ms Low Yin Leng of MOF justified the imposition of GST on WCT on the basis that:-

- “WCT forms part of the total price of water” and;

- “GST is charged on the final value of any goods or services consumed in Singapore”.

Wangchuk disagrees on the following basis:-

- WCT does not form the total price of water as the proceeds from WCT go to MOF’s pocket and not PUB’s pocket.

- PUB must be already charging an economic viable and sustainable pricing for water it is supplying to its customers.

WCT is truly and effectively a tax with the purpose of encouraging a change in behaviour and/or redirecting flow of economic resources.

Wangchuk cited a correct practice of GST on purchase of new cars ie.

“GST is charged on the selling price LESS ARF, COE, Registration Fee and Road Tax” as these are charges imposed by the LTA on vehicle buyers and do not relate to the provision of goods and services.

This leads me to cite my own doubt.

Are the smokers paying GST on the Tobacco Tax included in the selling price of a cigarrete pack?

Not that I care or worry that smokers have been overpaying. We want some consistency. So if PUB and/or MOF has/have made a mistake, just say so, correct the error and move on. Don’t try to explain your way deeper and deeper into the mess.